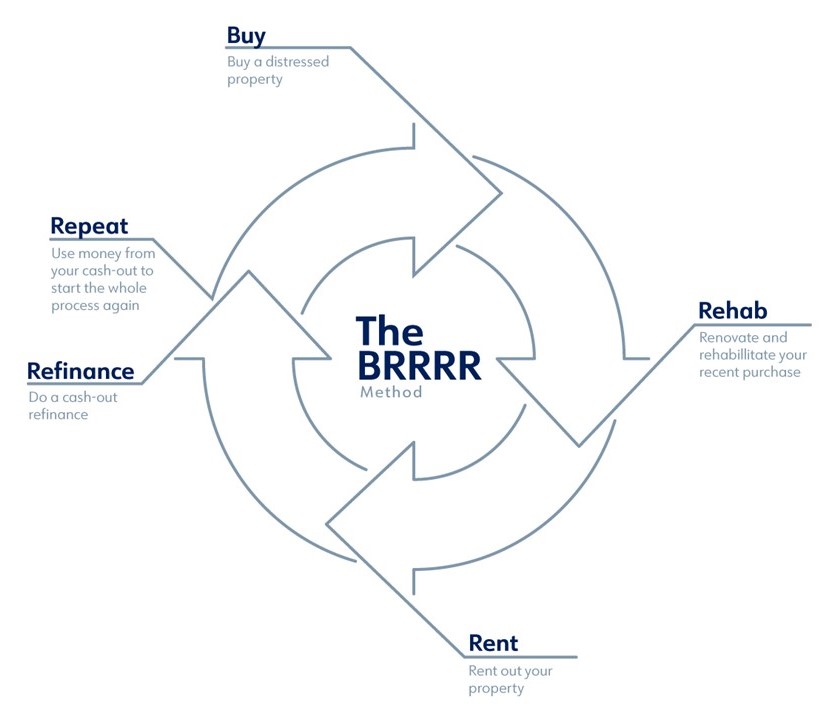

BRRRR strategy can provide passive income and a revolving method for purchasing and owning rental property. The method works through the following steps: Buy a property: The property you purchase should be a distressed property that needs some work to get […]

read more

Return on Investment

Do I Need Asset Protection for My Rental Properties?

What Is Real Estate Asset Protection? Asset protection in real estate is exactly what you’d expect: it protects you and your investments incase any unfortunate situations arise. The last thing any investor wants after spending his or her hard earned money […]

read more

read more

Why Consider A 1031 Tax Exchange?

When you are selling an investment property can be subject to taxation. Those taxes can add up quickly depending on the type of property, how long it was owned, state taxes, capital gains, depreciation and the owner’s tax bracket. As […]

read more

read more

5 Things You Should Know Before Investing in a Turnkey Property

What is Turnkey Investing? At its core, turnkey real estate investing is where you buy already rehabbed, tenant-filled, managed properties that are producing positive cash flow. A lot of the extra work that goes into real estate investing is cut […]

read more

read more

Why Some Real Estate Losses Will NOT Reduce Your Taxes

As you probably already know, there are many different types of entities available to investors. C corporations are often frowned upon due to their issue of double taxation. The corporation pays tax on the profit each year, and then any […]

read more

read more

The 1% Rule: What You Need To Know

Investing in real estate can be tricky if you’re not a numbers person (and I’ll be the first to admit that I’m not!) I can think of way better things to do with my time than build and analyze spreadsheets […]

read more

read more