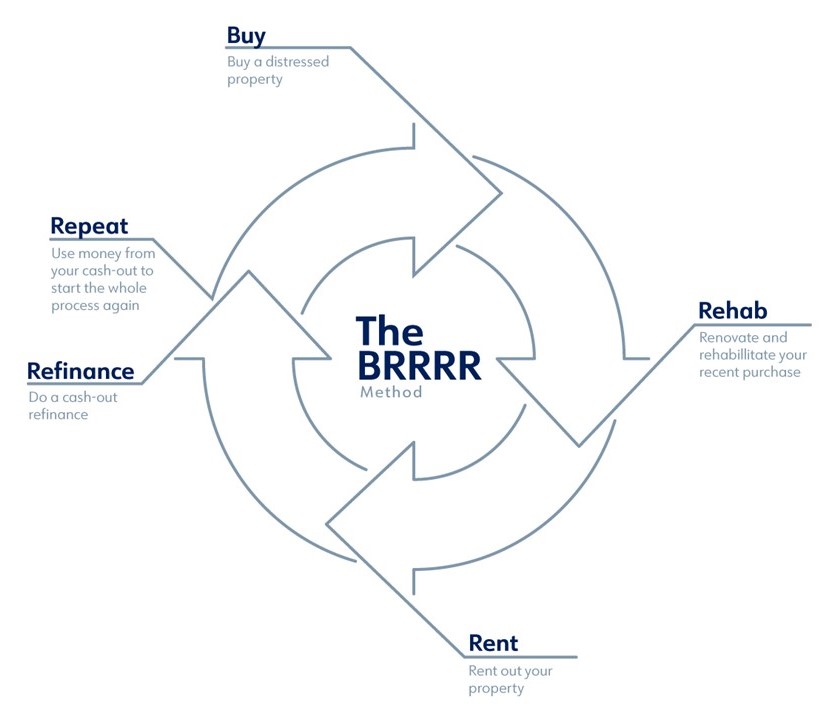

BRRRR strategy can provide passive income and a revolving method for purchasing and owning rental property. The method works through the following steps: Buy a property: The property you purchase should be a distressed property that needs some work to get […]

read more

Investor Loans

Why Do I have to Pay Points for a Loan in this Market?

5 Things You Should Know Before Investing in a Turnkey Property

What is Turnkey Investing? At its core, turnkey real estate investing is where you buy already rehabbed, tenant-filled, managed properties that are producing positive cash flow. A lot of the extra work that goes into real estate investing is cut […]

read more

read more

Fannie Mae Reserve Requirements for Investors with Multiple Properties Owned

What Are Reserves? Reserves are liquid or near liquid assets that are available to a borrower after the mortgage closes. On every loan transaction, reserves are required to be verified as part of the approval process. Acceptable sources or reserves […]

read more

read more

Is It Too Soon to Refinance My Mortgage Loan?

Mortgage rates have fallen a great deal this year and millions of homeowners as well as investors might benefit by refinancing even if they bought a home just last year. Mortgage rates moved lower last week even though the broader bond market […]

read more

read more

How Many Loans Will the Fannie Mae and Freddie Mac Lend to Investors?

In 2009, Fannie Mae and Freddie Mac rolled back the mortgage rule that prevented real estate investors from financing more than 4 properties per borrower. At the time, investors were limited to 4 properties financed, which included their primary residence. […]

read more

read more

Specialty Programs for Investors

HRM INVESTOR REHABILITION LOAN PROGRAM Program highlights include: 20% down payment No Limit on repair amounts Fees for up 5 draws are included Single-Family Homes 30 & 15 year fixed mortgage No prepayment penalty The cost consultant fee may be […]

read more

read more